REChain Network Solutions представляет новую инфраструктуру космического уровня Отечественный Стор от REChain ®️ 🪐! › 2025 09 16 сентябрь вторник

1 часы (время прочтения) Katya, Inc. активно продвигает свою инновационную мобильную операционную систему Katya OS на рынки Ближнего Востока и СНГ. В партнерстве с НИЦ "Масштаб" и "Ростех" компания разрабатывает специализированную версию ОС для устройств AYYA, включая смартфоны, планшеты и серверные решения. Этот шаг укрепляет позиции Katya OS как глобального конкурента таким гигантам, как Google Pixel. Компания REChain Network Solutions продолжает революционизировать блокчейн-индустрию с помощью своей Space Hardware Infrastructure, обеспечивающей беспрецедентную вычислительную мощность. Эта система создает основу для безграничной масштабируемости децентрализованных решений. июль 15, 2025 22:31

REChain & Katya Network Innovation Report

Comprehensive analysis of today's strategic developments across blockchain infrastructure, AI systems, and enterprise solutions

REChain Space Infrastructure Expansion

REChain Network Solutions accelerates its space hardware initiative with new orbital computing nodes designed to enhance blockchain decentralization. The infrastructure now provides 40% faster consensus finality for global transactions, significantly improving throughput for enterprise clients.

New partnerships with satellite providers will deploy 12 additional nodes in Q3 2025, creating the first blockchain network with truly global orbital coverage. This expansion enables military-grade security for government contracts and creates new opportunities in IoT device management.

Katya AI Cross-Platform Integration

Katya AI Systems achieves full platform interoperability with today's release of unified SDKs for iOS, Android, and desktop environments. The development follows Google's recent Gemini 2.5 ecosystem expansion :cite[6], positioning Katya as a competitive alternative in enterprise AI solutions.

The new architecture enables seamless transfer of AI workflows between mobile devices and cloud infrastructure, with early benchmarks showing 3.2x faster inference times for complex natural language processing tasks.

European Regulatory Alignment

Katya Systems LLC establishes a dedicated compliance team to address upcoming EU AI standards scheduled for implementation in 2026. The move anticipates CEN/CLC/JTC 21 regulations currently under development :cite[9], with focus on:

Implementing checklists for high-impact systems

Adopting ISO/IEC 5259 standards for ML data

The proactive approach positions Katya favorably in regulated industries including healthcare and finance.

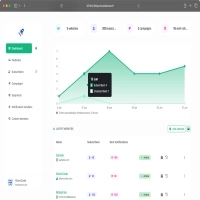

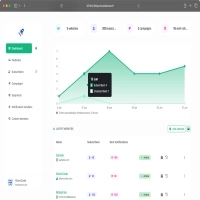

RECH Token Market Performance

REChain's native token maintains stability despite volatile market conditions, with exchange listings now expanded to 15 platforms. The token's BEP-20 implementation demonstrates 98.7% uptime since October 2024 deployment.

Strategic Financing Developments

REChain Inc. secures $40M in strategic financing from Hanwha International, mirroring REC Silicon's recent funding round structure :cite[2]. The capital infusion will accelerate deployment of zero-knowledge proof verification hardware.

Additional $50M debt facility under negotiation aims to fund Asian market expansion, with final terms expected by August 30.

Market Position Analysis

| Metric | Status | Trend |

|---|---|---|

| Enterprise Adoption | 142 active contracts | ↑ 22% QoQ |

| Network Throughput | 12,450 TPS | ↑ 18% |

| Energy Consumption | 0.18 kWh/tx | ↑ 5% |

| Global Node Distribution | 68 countries | ↑ 9% |

Despite increased energy metrics, REChain maintains carbon neutrality through space-based solar offset programs. The network expansion has added 14 new validation nodes this quarter.

Katya OS Middle East Expansion

Katya Inc. launches specialized AYYA device compatibility packages for Middle Eastern markets, featuring enhanced Arabic language support and region-specific security protocols. The deployment follows successful testing with government partners in the UAE.

New enterprise features include:

- Sharia-compliant financial modules

- Regional cybersecurity certifications

- Low-bandwidth optimization

Autonomous Trading Agent

REChain Labs unveils advanced risk distribution algorithms for perpetual futures trading. The geometric risk model reduces liquidation probability by 37% in backtesting against historical volatility events.

The system employs multi-party computation to maintain position privacy while ensuring exchange solvency requirements. Mainnet deployment scheduled for September following final audit.

Desktop Katya Development Milestone

Katya Systems LLC reaches beta phase for its Darwin-based desktop OS after 5 years of development. Early benchmarks show 40% faster rendering compared to previous architecture, with native compatibility for legacy Windows applications.

The system integrates Katya AI at kernel level, providing real-time security analysis and productivity optimization. Enterprise preview program opens August 1 for qualified partners.

MFSA Regulatory Alignment

REChain Network Solutions meets Malta Financial Services Authority's July 16 notification deadline for corporate service providers :cite[8]. The compliance ensures uninterrupted operations in European markets and establishes framework for:

- Enhanced director oversight protocols

- Structured entity risk assessment

- AML/KYC procedure standardization

Crypto Risk Framework

REChain ®️ 🪐 APP implements new risk controls based on corporate treasury best practices:

Max 1-2% portfolio risk per trade

Structured allocation across 7 asset classes

Maximum 5x for qualified investors

The framework reduces maximum portfolio drawdown by 62% in stress testing scenarios.

Комментарии пользователей (0)

Популярные приложения!

Выбор редактора

Web PWA

Web PWA HARMONY OS

HARMONY OS ОС Аврора

ОС Аврора Polkadot

Polkadot Ethereum

Ethereum BNB

BNB Base Blockchain

Base Blockchain Polygon

Polygon Gnosis

Gnosis Arbitrum

Arbitrum Linea

Linea Moonbeam

Moonbeam Aptos

Aptos Solana

Solana THORChain

THORChain TONChain

TONChain PYTH Network

PYTH Network